Uncover market trends in seconds, not hours. Get an investing edge with Al powered financial news and social media analysis. Over 1,500+ financial news articles analyzed daily from 50 top financial ne...

Streetbeat is at the forefront of financial technology innovation, offering personalized investment solutions through its AI-powered financial advisor. Streetbeat aims to make investing accessible to ...

Coinrule empowers users to create and deploy automated trading bots effortlessly. With no coding required, you can follow expert investors, seize market opportunities, and trade across major exchanges...

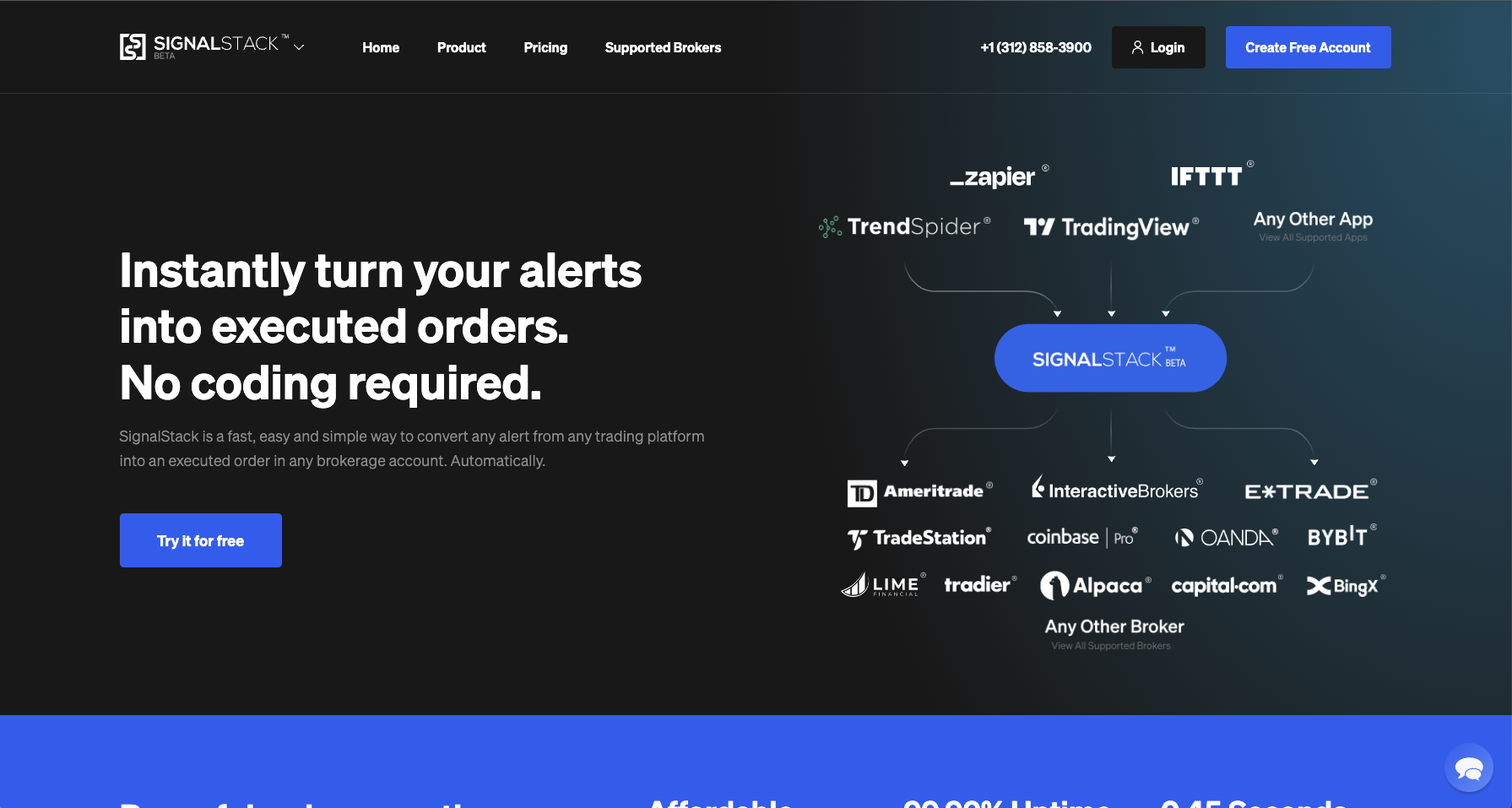

Transform your orders into notifications instantly. No coding is necessary. Any alert from any trading platform may be quickly, easily, and simply converted into an executed order in any brokerage acc...

Uncover market trends in seconds, not hours. Get an investing edge with Al powered financial news and social media analysis. Over 1,500+ financial news articles analyzed daily from 50 top financial news sources. Over 2 million+ social media posts analyzed daily from X/Twitter and Reddit.

Streetbeat is at the forefront of financial technology innovation, offering personalized investment solutions through its AI-powered financial advisor. Streetbeat aims to make investing accessible to all, revolutionizing how individuals manage their financial futures. The app’s interface allows you to ask questions and tap into hundreds of data sources, in an easy conversational way, like talking to a financial advisor. Whether you want to create your own customized portfolio, or invest in a popular curated portfolio, Streetbeat caters to your unique investment goals. Streetbeat membership is a month-to-month or yearly subscription that starts at sign up: Annual: $15 /month - $179 billed annually. Monthly: $25 per month.

The Must Have Stock Scanner for All Active Traders. A whole new visual perspective on scanning the market is provided by the Stock Racing technology. Greetings from the future of stock scanning, which Trade Ideas is the only business to provide.

Transform your orders into notifications instantly. No coding is necessary. Any alert from any trading platform may be quickly, easily, and simply converted into an executed order in any brokerage account using SignalStack. Automatically.

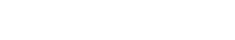

1 Billion+ Comparisons of Stock Trading Strategies. AI trading bot tools like AI robot; signals, virtual accounts, AI trend predictions, and a lot more.

TrendSpider is the ultimate all-in-one trading platform designed by traders, for traders. It offers a comprehensive toolkit with real-time data, intuitive charting software, and free technical support, empowering users to make smarter, faster, and more strategic trading decisions effortlessly.

I’ll send you a full list of all the best AI tools to supercharge your work. (updated weekly)

Artificial intelligence (AI) has revolutionized the stock trading industry by harnessing powerful computational capabilities to emulate human logic and expertise at an advanced level.

Through automated processes and rules, AI and machine learning (ML) mitigate computational human error and significantly reduce the time-consuming nature of tasks.

The remarkable ability of various AI technologies to process vast amounts of readily available data and datasets is a key factor in their efficacy.

These datasets are applied in real-time scenarios, enabling accurate forecasts and profitable trades.

An impactful transformation brought about by AI in stock trading is the integration of AI trading bots and optimize trade ideas.

These intelligent machines offer swift decision-making capabilities and a remarkable reduction in errors, leading to enhanced profitability.

With a plethora of exceptional choices for best trading bots available, let us explore the top eight AI-driven stock trading bots on the market today.

An AI stock trading bot is an advanced software program that utilizes artificial intelligence (AI) algorithms and machine learning techniques to automate the process of trading stocks in financial markets.

These bots are designed to analyze vast amounts of market data, including historical and real-time data, news, and various indicators, to make informed trading decisions.

By leveraging AI capabilities, these bots can identify patterns, trends, and signals that may not be easily detectable by human traders.

They execute trades automatically based on predefined rules and strategies, aiming to maximize profits and minimize risks.

AI stock trading bots offer speed, accuracy, and efficiency of ai stock trading bots, enabling traders to capitalize on market opportunities effectively.

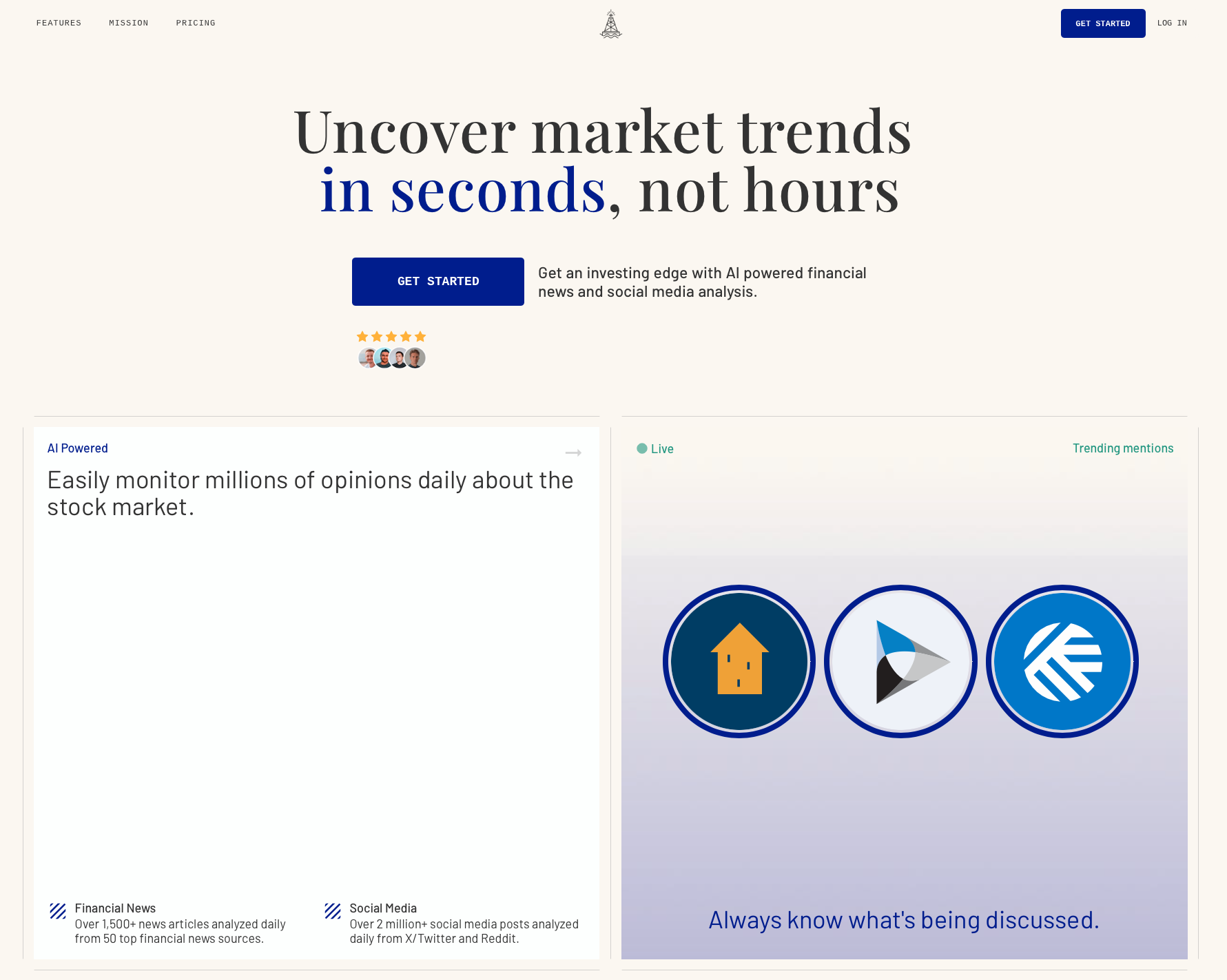

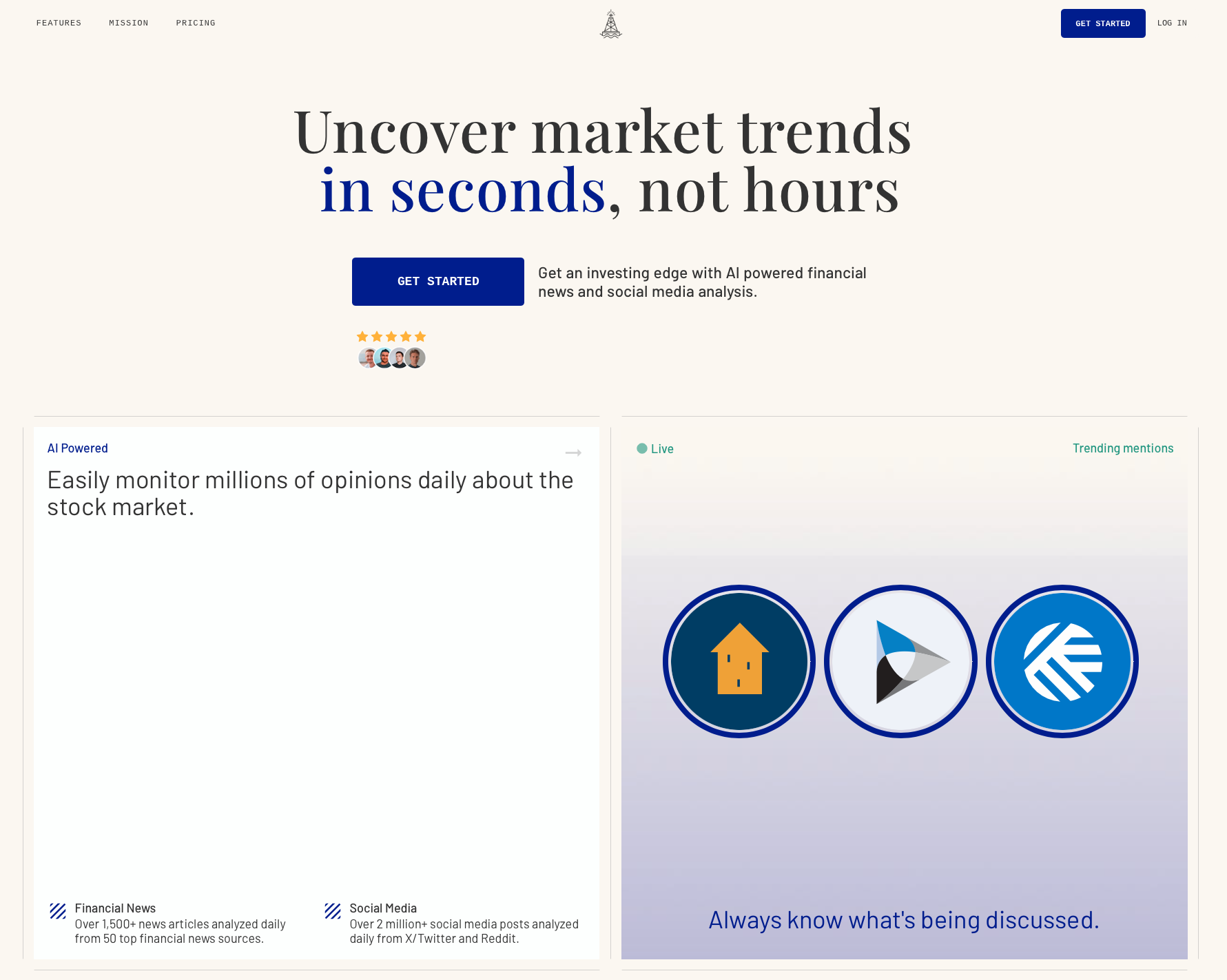

Signm offers a rapid analysis of market trends, leveraging AI-powered tools to give investors an advantage through financial news and social analysis.

It continuously monitors over 2 million opinions daily about the stock market, ensuring users are always informed about prevailing discussions.

The platform analyzes over 1,500 news articles daily from 50 leading financial news sources, incorporating diverse perspectives from major outlets such as CNN, Forbes, and The Motley Fool.

In addition, it also examines over 2 million social media posts each day from platforms like Twitter and Reddit, providing actionable insights by capturing the pulse of the market.

Signm identifies sentiment shifts, revealing public opinion about various companies. It helps users spot early trends in market conversations, leveraging decades of expertise in AI, machine learning, and quantitative finance.

This offers unique insights, similar to strategies used by sophisticated Wall Street investors. By using AI, Signm uncovers hidden investment opportunities, predicts market movements, and assists you in making better decisions for a competitive edge.

It measures sentiment, ranging from bearish to bullish, providing insights into market perceptions. Articles and social media posts are analyzed and scored for relevance, ensuring that only pertinent information is highlighted.

You can save 79% off for a limited time.

Premium subscription: $59 per month at full price

Ranked as our top pick among AI stock trading software, Trade Ideas stands out for its impressive software and exceptional team comprised of visionary fintech entrepreneurs and skilled developers.

The company has meticulously developed its own technology, engaging a team of talented US developers whose server connects directly to Exchanges.

Operating in real-time, the system meticulously monitors every stock market every tick and assesses bear market behavior against historical data.

Trade Ideas caters to investors of all experience levels. Novices can swiftly learn through simulated training and practice sessions, while intermediate traders can enhance their skills with prebuilt AI trading management tools.

Seasoned experts can fully customize their automated trades and leverage AI to refine them, and trade ideas.

An essential offering from Trade Ideas is their AI-Holly bot, which suggests statistically weighted Entry Signals and offers various Exit Signals based on risk reduction for intraday trades.

The platform also features Full Quote Windows that provide comprehensive fundamental data for each stock, and users can personalize their channels or choose from preconfigured layouts using the custom layout option.

You can save 30% on all pricing below:

Premium: $167/Month; Annually $1999

Standard: $84/Month; Annually $999

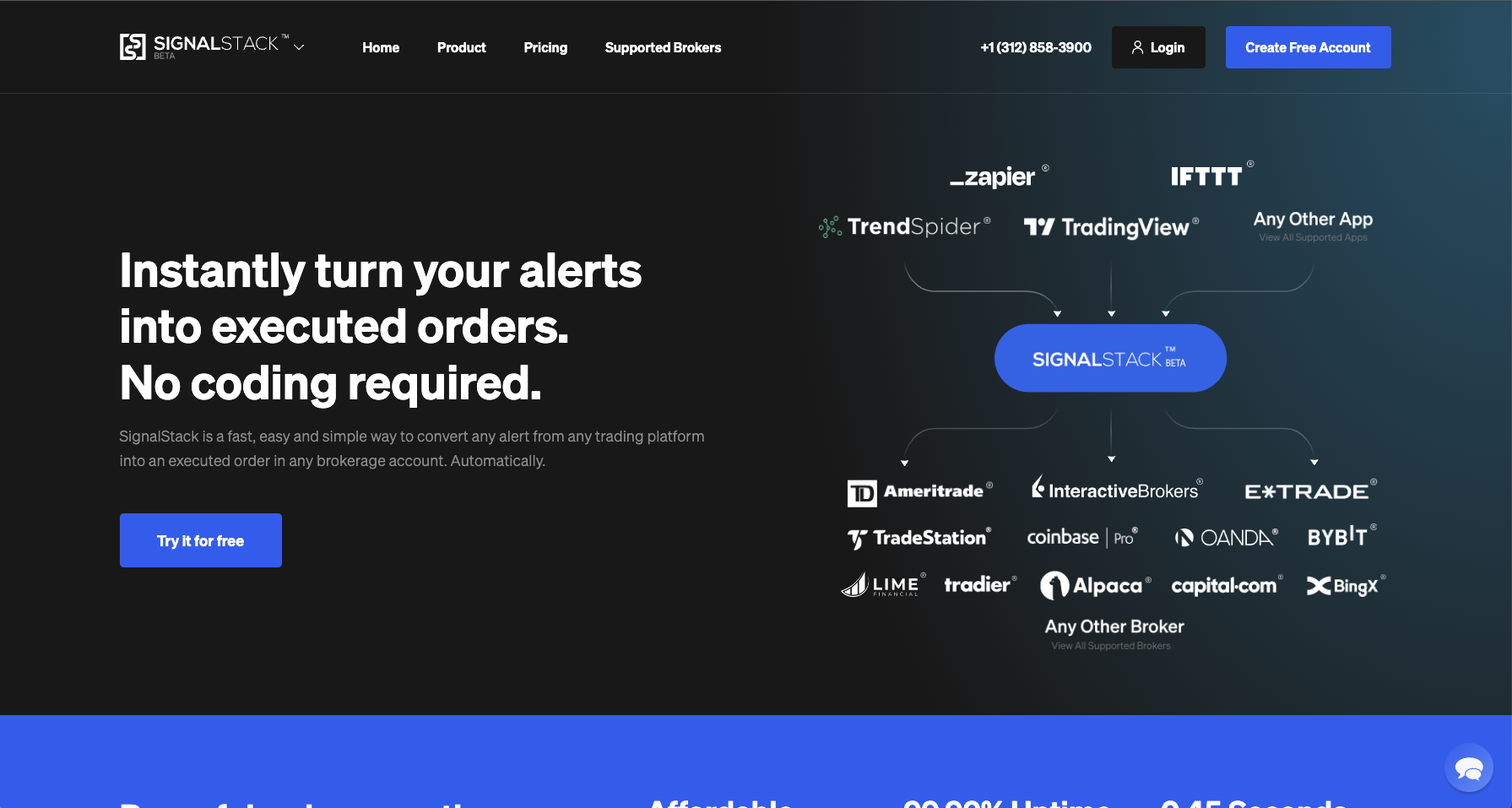

SignalStack offers a seamless, efficient, and user-friendly solution to transform alerts from various trading platforms into executed orders within any brokerage account.

With automation at its core, SignalStack empowers traders by leveling the playing field, enabling them to automate their orders similar to hedge funds.

This enterprise-grade platform is designed for high availability and reliability, ensuring uninterrupted functionality.

It seamlessly processes incoming signals from external systems, swiftly converting them into live orders within brokerage accounts.

This technological capability was previously inaccessible to retail traders. You can now use AI stock trading bots for AI trading, understanding trading algorithms and the stock market.

First 25 Signals are free, then as low as $0.59 each

50 for $74.50; $1.49 per signal

100 for $119; $1.19 per signal

200 for $218; $1.09 per signal

400 for $396; $0.99 per signal

1,000 for $890; $0.89 per signal

2,000 for $1,580; $0.79 per signal

5,000 for $3,450; $0.69 per signal

10,000 for $5,900; $0.59 per signal

When it comes to top AI stock trading bots, Tickeron emerges as a prime choice, offering a comprehensive platform with a diverse range of AI trading options.

The highlight of this platform is its AI Robots, which provides real-time visibility into executed trades, including potential profits and stop losses.

Tickeron’s AI Robots constantly scan stocks and ETFs every minute, presenting them in a customizable field. Get a brokerage account and use automated trading bots.

Traders can fine-tune their selection from the provided list, and the AI Robot diligently analyzes the tickers to identify trading opportunities based on real-time patterns.

Additionally, AI Robots operate automated investing rooms where trades are executed based on multiple neural networks. This makes a trading bot and ai trading very valuable.

Among Tickeron’s impressive features is AI Trend Forecasting. The trading bot will leverage historical price data, the platform’s AI trend prediction engine accurately forecasts shifting stock market move trends, each trend prediction engine accompanied by a confidence level that indicates the probability of success for each predicted trend.

The platform also offers customization options for confidence levels. Users can set a minimum confidence threshold for AI-recognized trends and patterns, allowing more risk-averse individuals to utilize proven techniques that align with their risk tolerance.

Tickeron equips traders with powerful AI-driven tools, empowering them to make informed trading decisions and capitalize on market trends with confidence.

Freemium: $0/mo

Intermediate One: $90/mo; plus possible add-ons

Intermediate One: $180/mo; plus possible add-ons

Lux Algo v2 is a TradingView-based manual trading system that requires users to possess market knowledge.

Given the inherent risk involved in trading, it is crucial to comprehend the trading signals provided by the system and consider starting with a demo account to familiarize oneself with Lux Algo.

Lux Algo offers flexibility, allowing users to apply it across multiple instruments and timeframes, accommodating short, mid, and long-term trade ideas.

To optimize results, it is imperative to establish a robust trading plan, exercise discipline, and employ effective money management practices, as is prudent with any trading system.

Lux Algo v2 empowers traders with a comprehensive trading system, offering access to valuable resources and support. It is great for experienced traders.

By leveraging this platform, traders can enhance their trading and investment strategies, and effectively navigate the dynamic financial markets.

Monthly: $67.99

Quarterly: $143.97 (Save 30%)

Yearly: $489.99 (Save 40%)

TrendSpider introduces a cutting-edge stock market platform with advanced automatic technical analysis, driven by its unique machine learning algorithm.

Designed to cater to a wide range of users, from day traders to general investors, this stock analysis software delivers comprehensive functionality.

TrendSpider’s proprietary algorithm meticulously scans historical market data, uncovering trends in the forex market.

These identified trends and trading signals are then relayed by artificial intelligence to human traders, who leverage this information to execute effective and profitable trades.

The platform’s Trading Bots serve as a valuable tool, allowing users to transform their strategies into fully automated, position-aware bots capable of performing a diverse range of tasks.

Traders can fine-tune and refine their strategies using the platform’s Strategy Tester before deploying them as Trading programs.

Trading software enable users to automatically trigger events when specific conditions from their strategies are met. This could involve posting to a private Discord server or activating an order routing system to execute trade ideas within a brokerage or exchange account.

Highly customizable and flexible, Trading software can be tailored to match the exact specifications of a user’s strategy.

They operate on various timeframes, from 15 minutes and beyond, and are backed by a cloud-based system.

In addition to Trading Bots, TrendSpider’s all-in-one platform provides scanning and screening capabilities for enhanced first trade, trading ideas, and setups, smart charts that save time, dynamic price alerts to improve your trade ideas and timing, and numerous other features.

TrendSpider equips traders with an extensive suite of tools and features, empowering them to make informed trading decisions, enhance their strategies, and seize opportunities in the dynamic world of finance.

Essential: 7 days free, then $32.00 $27.20/month

Elite: 7 days free, then $65.00 $42.25/month

Elite Plus: 7 days free, then $135.00 $67.50/month

AI trading and a trading bot can help you increase profits. It can help you execute on trade ideas, since the trading bot and AI trading removes personal bias.

Let’s delve into the world of automated trading and discover the potential it holds for traders.

With the advent of AI stock trading bots, traders can now implement a complex trading stragey with ease.

These bots are programmed to analyze vast amounts of market data and make informed decisions in real-time.

By utilizing advanced algorithms, they can identify profitable trading opportunities that might otherwise go unnoticed.

With the ability to understand trade signals instantly, AI bot eliminate the delays associated with manual trading, ensuring that you capitalize on time-sensitive trading opportunities efficiently.

One of the biggest challenges traders face is keeping emotions in check during trading. Fear, greed, and other human emotions can cloud judgment and lead to costly mistakes.

AI trading and using a trading bot eradicate this problem by operating purely based on predefined rules and algorithms.

You can use a trading bot with your brokerage account to invest in AI stocks, for market analysis and execute on trade ideas.

They make decisions solely on conditions and statistical analysis, eliminating the impact of emotions.

AI trading takes the personal bias away from the equation since the trading bot is based on trade ideas and algorithms.

As a result, automated trading software can consistently execute on trade signals without being swayed by fear or excitement, leading to more disciplined and objective, trading performance.

Effective risk management is crucial for any trader. AI bot play a significant role in mitigating risks by adhering to predetermined trade ideas and strategies.

These bots can implement stop-loss orders, trailing stops, and other way to go about the stock market and techniques automatically.

By swiftly reacting to market movements and implementing risk controls, stock trading bots help safeguard your investments and prevent significant losses.

With automated trade signals in place, you can trade with confidence, knowing that your portfolio is protected.

The financial markets are dynamic and can experience rapid fluctuations within seconds. To capitalize on these opportunities, traders need to act swiftly.

Stock trading bots excel in this regard, as they can understand technical analysis and the stock market at lightning speed, ensuring you don’t miss out on lucrative deals.

Moreover, they are programmed to operate with high precision, minimizing the chances of errors that can occur during manual trading.

A trading bot and AI trading can boost your trade ideas.

The combination of speed and accuracy gives stock trading bots a clear advantage, enabling you to stay ahead of the competition.

Before deploying a trading strategy, it’s essential to test its effectiveness. Stock trading bots offer a valuable feature known as backtesting.

This allows traders to evaluate their strategies using historical technical analysis and past performance. By simulating trades based on past performance, traders can assess the profitability and risks associated with their strategies.

A trading bot can improve your trade ideas and the way you invest.

Additionally, stock trading bots can optimize trading parameters based on market analysis and technical analysis, maximizing the chances of success when the strategy is applied in real-time trading.

AI trading software can be effective tools for automating your trading strategy and executing trades in financial markets.

These bots are designed to use artificial intelligence and machine learning algorithms to analyze large amounts of data, identify patterns, and make trading decisions based on predefined rules or adaptive strategies.

Here are some key points to consider when evaluating the effectiveness of trading software:

It’s important to note that the effectiveness of trading software can vary depending on various factors, including the quality of data inputs, the sophistication of the underlying algorithms, and the skill of the bot’s developers. Additionally, regulatory considerations and risk reduction practices are crucial when utilizing AI trading bots to ensure compliance and mitigate potential risks.

These trading bots have the potential to generate profits in financial markets, but their success is not guaranteed.

These bots utilize complex algorithms and machine learning techniques to analyze vast amounts of data, identify patterns, and make trading decisions.

The advantage of AI trading software lies in their ability to process and analyze data faster than humans, enabling them to identify potential trade ideas and trade with minimal delay.

They can monitor multiple markets simultaneously, detect market trends, and react to market changes swiftly, which can result in timely and profitable trades.

However, the profitability of trading bots depends on various factors. The accuracy and reliability of the underlying algorithms, the quality of data used for training and decision-making, and the adaptability of the bots to changing conditions all play a crucial role. Additionally, market unpredictability and sudden events can introduce unforeseen risks that may lead to losses.

While trading software have shown promising results in some cases, it is important to note that financial markets are highly complex and influenced by various factors, including economic indicators, geopolitical events, and investor sentiment. The effectiveness of trading ultimately depends on the quality of their programming, continuous monitoring, and adjustment to evolving market dynamics.

Investors should exercise caution and conduct thorough research before relying solely on AI stock trading bots. Professional guidance, risk management strategies, and human oversight remain essential to navigate the intricacies of financial markets and maximize the potential profitability of trading software.

Yes, it is generally legal for AI to trade stocks. However, the legality of AI trading software may vary depending on the jurisdiction and specific regulations governing financial markets in different countries.

In many jurisdictions, a trading bot are considered automated trading systems and are subject to regulations and oversight by financial regulatory authorities. These regulations aim to ensure fair and orderly markets, protect investors, and prevent market manipulation. It is essential for AI trading software to comply with these regulations, including licensing requirements, reporting obligations, and adherence to market rules.

Financial regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and similar agencies in other countries, have specific guidelines and requirements for algorithmic trading and automated systems. These guidelines often cover aspects such as risk management, algorithm testing, and monitoring for market abuse.

It is important for individuals or organizations using AI trading software to understand and comply with the applicable legal and regulatory requirements in their jurisdiction. Consulting with legal and financial professionals who specialize in securities and trading regulations can help ensure compliance and mitigate potential legal risks associated with AI trading activities.

AI trading, also known as algorithmic trading or automated trading, refers to the use of AI and advanced computing technologies to make trading decisions in financial markets.

Trading involves the development and deployment of sophisticated algorithms that analyze vast amounts of data, including market prices, news, economic indicators, and other relevant information, to identify trading possibilities and execute trades.

Trading systems are designed to automate the entire trading process, from data analysis to order placement and execution. These systems can process information at high speeds, identify patterns and trends, and make trading decisions based on predefined rules or machine learning algorithms. By removing human emotions and biases from the trading process, AI and trading ideas aims to enhance efficiency, accuracy, and speed.

Trading software can encompass various strategies, including trend following, mean reversion, statistical arbitrage, and high-frequency trading. The algorithms used in trading software are continuously refined and optimized to adapt to changing conditions and improve performance.

The potential benefits of trading with AI include increased trading efficiency, reduced transaction costs, improved risk management, and the ability to identify and exploit trading opportunities in real-time. However, it is important to note that trading also carries risks, including technical failures, data quality issues, and regulatory compliance challenges. Proper risk management, robust algorithm development, and continuous monitoring are crucial for successful trading methods.

The potential earnings from trading can vary significantly and are influenced by various factors.

It is important to note that while trading software have the potential to generate profits, there is no guarantee of consistent or substantial earnings. The following factors can impact the earnings from trading:

To summarize everything, here are the top 7 AI stock trading bots:

Click the link and take a look to find which one you like the best.

At Insidr.ai we share AI news, AI guides and help you find the best tools for AI.

Click the button below to see the full directory of AI-powered tools sorted by categories.

👉 Join our email list to keep up to date with all the latest AI-news and tools.

We’ll also send you our full list of 300+ of the best tools.

Copyright 2024 | Insidr AI ApS | All Rights Reserved.

FREE AI TOOLS LIST

Browse 500+ AI Tools in 78+ categories – only the best, not the rest.

When you join, you will get an email with a link to the AI tools list + access to the AI Community with a lot more free AI resources!